Content

Anyone who earns any taxable income in the course of a year, whether an employee or a self-employed person, reports their individual income through the master sheet tax return — Form 1040. Self-employed professionals required to have liability insurance should consider setting up their own insurance company. A captive insurance company is one that insures the risks of the business—or businesses, in the case of a cooperative.

Next Insurance, Inc. and/or its affiliates is an insurance agency licensed to sell certain insurance products and may receive compensation from insurance companies for such sales. Policy obligations are the sole responsibility of the issuing insurance company. Refer to Legal Notices section for additional information. If you got a loan from a bank to fund your business, you might deduct the interest as a business expense. If you used your loan for both business and personal expenses, you need to track how much of it went to your business and only deduct the interest from that portion.

Premiums for Business Insurance

As we explain in the section about health insurance, you might be able to deduct some or all of your health insurance premiums if you’re self-employed. But you can qualify even if the education leads to a degree. If you bought medical insurance policies on your own for yourself or your Tax Deductions For Independent Contractors family, you might qualify for a self-employment tax deduction on the premiums. Please see the policy for full terms, conditions and exclusions. Your policy documents govern, terms and exclusions apply. Coverage is dependent on actual facts and circumstances giving rise to a claim.

- On the other hand, you’re not an independent contractor if your payer has the legal right to control how you do your work — even if you’re generally provided the freedom of action.

- So, you can write-off clothing for work that is promotional as a miscellaneous deduction on your tax return.

- Specific tax obligations will depend on whether the business resulted in a net profit or a net loss.

- The latter term stems from the name of a form payers use to report the compensation paid to contractors (which we’ll explain in more detail later).

- You can also avail of this deduction if your employees need to take meals in the office for some reason.

- If you got a loan from a bank to fund your business, you might deduct the interest as a business expense.

Even so, many freelancers miss out on great opportunities for write-offs. But, as an independent contractor, you pay the entire sum yourself through the SE tax. Since you don’t have an employer who can withhold money from your paycheck for FICA taxes, you need to do it yourself.

How do I file a 1040 tax return?

The IRS standard mileage rate for tax deductions is 56 cents per mile. The rules for calculating the rate are updated every tax year, so it’s good to stay current. Some people don’t like paying insurance premiums because they perceive them to be a waste of money if they never have to file a claim.

With self-employment comes freedom, responsibility, and a lot of expense. While most self-employed people celebrate the first two, they cringe at the latter, especially at tax time. They might not be aware of some of the https://kelleysbookkeeping.com/ tax write-offs to which they are entitled. Searches 500 tax deductions to get you every dollar you deserve. Hard hats, boots, and tool belts are essential to the construction trades and definite business deductions.

Education and Training

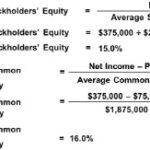

Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy. This IRS allows you to deduct fifty percent of the self-employment tax from your net income. This is because the IRS considers the employer part of the self-employment tax to be a business expense and lets you deduct it as such. The first phone line in your home isn’t deductible, even if you have an office at home. However, you can deduct amounts paid if you incur business long-distance charges or have a second phone line reserved for business use.

The distinction between the two is not always clear and will depend on the unique circumstances in each case. If you pay for childcare for your dependent, you can deduct the cost from your taxable income. This deduction is available to independent contractors with a dependent who is under the age of 13.

Unfortunately, if the contractor suffers more than one loss within a tax year, $100 from each loss amount can be deducted minus any funds received from insurance policies. Often, even clients might ask for an insurance certificate before signing a contract with an independent contractor. Independent contractors might have significant home office expenses. For example, they might use a part of their home as a teaching space, a yoga studio, or something else. As a contractor, you can deduct a portion of the cost every year until you fully recover the total cost of your equipment. Depreciation is the recovery of the cost of the property over a number of years.